When it comes to the financial landscape of any state, its banks play a crucial role in driving economic growth and stability. This is especially true for a state like Arizona, which has seen significant growth in recent years and has a thriving economy. In this blog post, we will take a closer look at the largest banks in Arizona, their rankings, and how they contribute to the state’s financial landscape. We will also delve deeper into the current trends, challenges, and future outlook for Arizona’s banking sector.

Ranking the Biggest Banks in Arizona

Arizona is home to many large and well-established banks, catering to the diverse needs of its population. According to data from the Federal Deposit Insurance Corporation (FDIC), the top five banks in Arizona by total assets as of June 2021 are:

1. Wells Fargo

Wells Fargo has been a prominent player in the Arizona banking scene since 1917, when it opened its first branch in Phoenix. With over 190 branches across the state, it currently holds the top spot in terms of total assets, with over $41 billion. It is also the second-largest bank in the US, providing a wide range of financial services to both individuals and businesses.

2. Bank of America

With assets totaling more than $29 billion, Bank of America ranks second in Arizona and is also among the largest banks in the country. The bank has a network of around 100 branches in the state, offering various banking products and services ranging from checking and savings accounts to loans and investments.

3. JPMorgan Chase

JPMorgan Chase has a significant presence in Arizona, with more than 150 branches and close to $24 billion in assets. It is one of the oldest banks in the state, dating back to the late 1800s. The bank offers a wide range of financial solutions, including credit cards, mortgages, and investment services.

4. U.S. Bancorp

U.S. Bancorp is another major player in Arizona’s banking sector, with assets worth over $19 billion. The bank has a network of over 80 branches across the state and provides a range of financial services, including lending, wealth management, and payment solutions.

5. BBVA USA Bancshares

BBVA USA Bancshares is a relatively new entrant in Arizona’s banking industry, having established its presence in the state in 2005. However, it has quickly risen to become one of the top players in the market, with assets worth over $18 billion. The bank offers a wide variety of financial products and services, including personal and business banking, mortgages, and insurance.

Financial Landscape of Arizona: A Closer Look

Arizona’s financial landscape has evolved significantly in recent years, with the state experiencing steady economic growth and a surge in population. As a result, the demand for financial services has also increased, leading to the rise of new banks and the expansion of existing ones.

One factor contributing to Arizona’s healthy financial landscape is the state’s pro-business policies and low tax rates, making it an attractive location for businesses to operate. Additionally, Arizona boasts a diverse economy with strong industries such as healthcare, technology, and tourism, providing a stable stream of customers for its banks.

Moreover, Arizona has a growing population, with an estimated 7.4 million residents as of 2021. This population growth has fueled the demand for housing and other essential services, creating a favorable environment for banks to offer mortgages and consumer loans.

Growth and Consolidation: Arizona’s Banking Sector

The banking sector in Arizona has seen a fair share of mergers and acquisitions in recent years, leading to consolidation. One example is the recent merger between BBVA USA Bancshares and PNC Financial Services Group, which resulted in a combined entity with assets worth over $560 billion.

Such consolidations can have advantages for both banks and consumers. On the one hand, they allow smaller banks to compete with larger ones and expand their reach. On the other hand, consumers may benefit from improved services, technological advancements, and competitive interest rates.

However, some experts also argue that consolidation could lead to reduced competition and fewer options for consumers, ultimately resulting in higher fees and less innovation in the long run.

Assessing the Financial Stability of Arizona’s Banks

The Federal Reserve conducts regular stress tests to assess the financial stability of banks in the US, including those in Arizona. The tests evaluate a bank’s capital adequacy, risk management, and overall ability to withstand adverse economic conditions.

In the past few years, most of Arizona’s banks have performed well on these tests, highlighting their resilience and robust risk management practices. This gives consumers confidence in the stability and safety of their deposits.

Additionally, Arizona banks are also subject to regular examinations by the FDIC to ensure compliance with regulations and maintain the integrity of the financial system.

Emerging Trends in Arizona’s Banking Industry

As with any other industry, the banking sector in Arizona is constantly evolving to keep pace with changing consumer demands and technological advancements. Some of the emerging trends in the state’s banking industry include:

1. Digitalization and Fintech

As more consumers embrace digital banking services, Arizona’s banks are investing heavily in digital technologies to enhance their online and mobile banking platforms. This trend has only accelerated amid the ongoing COVID-19 pandemic, where digital banking has become a necessity rather than an option.

Moreover, fintech companies, which offer innovative financial solutions through technology, are also gaining traction in Arizona. Many banks are partnering with fintech startups to offer services such as online payments, budgeting tools, and investment management to attract younger customers.

2. Sustainability and Social Responsibility

With growing concerns about climate change and social issues, many banks in Arizona are incorporating sustainability and social responsibility into their operations. This includes initiatives such as funding renewable energy projects, supporting local communities, and promoting environmental stewardship.

This trend is driven by consumer demand for socially responsible and environmentally friendly banking options, as well as regulatory pressure for banks to consider ESG (environmental, social, and governance) factors in their decision-making.

3. Personalization and Customer Experience

In a highly competitive market, banks in Arizona are focusing on providing personalized and seamless customer experiences. This includes tailoring products and services to meet specific customer needs, offering self-service options, and improving the overall user experience through advanced technologies.

This trend not only helps banks attract and retain customers but also allows them to gather valuable data and insights to improve their offerings continuously.

Arizona’s Banking Market: A Comparative Analysis

While Arizona’s banking sector is thriving, it faces stiff competition from neighboring states, such as California and Texas. Therefore, a comparative analysis of the industry can provide valuable insights into the state’s strengths and weaknesses.

According to FDIC data, Arizona’s banks have seen steady asset growth over the years, with a compound annual growth rate (CAGR) of 6.8% from 2016 to 2021. This growth is lower than California’s (9.3%) but higher than Texas’s (3.2%).

In terms of loans and deposits, Arizona banks have also seen higher CAGRs compared to Texas but lower than California. This indicates that while Arizona’s banking market is growing, it still has room for further expansion and development.

The Impact of Arizona’s Economic Environment on its Banks

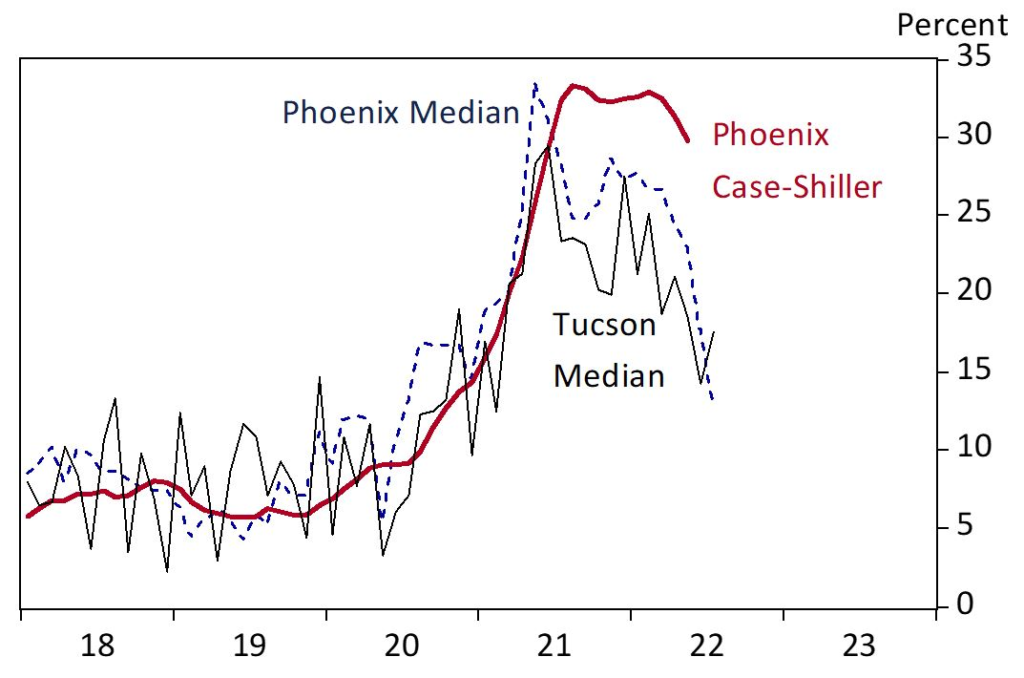

Arizona’s economy is heavily reliant on sectors such as real estate, construction, healthcare, and tourism, which can be vulnerable to economic downturns. Therefore, any fluctuations in the state’s economic environment can have a significant impact on its banks.

For example, during the 2008 financial crisis, Arizona experienced a severe housing market crash, leading to substantial losses for its banks. However, the state has since recovered and seen consistent economic growth, with its GDP increasing by 5.1% in 2019, outpacing the national average.

Currently, Arizona’s economy is facing challenges due to the COVID-19 pandemic, but the state government has taken measures to support small businesses and boost economic recovery. These efforts are critical for ensuring the stability and growth of Arizona’s banking sector.

Arizona’s Banks: A Driving Force for the State’s Economy

Banks are not only essential for providing financial services to individuals and businesses, but they also play a crucial role in driving economic growth. This is particularly true for a state like Arizona, where banks are a significant source of employment and contribute to the overall health of the economy.

According to the Arizona Bankers Association, the state’s banking industry employs over 50,000 people, directly and indirectly. Moreover, banks also contribute to the state’s tax revenues and invest in local businesses, further boosting economic activity.

In addition, access to credit from banks allows businesses to expand and create jobs, promoting economic development and prosperity.

Future Outlook for Arizona’s Banking Sector

Despite the challenges posed by the COVID-19 pandemic, the future looks promising for Arizona’s banking sector. The state’s economic growth, coupled with a growing population and business-friendly policies, bodes well for its banks’ continued success.

However, the industry must adapt to changing consumer expectations and technological advancements to remain relevant and competitive. Additionally, banks must also stay vigilant and proactive in managing risks and maintaining financial stability.

Conclusion

Arizona’s banking sector is a critical component of its economy, providing essential services to individuals and businesses and driving economic growth. The state’s top banks, such as Wells Fargo, Bank of America, and JPMorgan Chase, have a significant presence and continue to see steady growth.

While the industry faces challenges, such as consolidation and changing consumer preferences, it also presents many opportunities for growth and innovation. With the right strategies and a supportive economic environment, Arizona’s banks are poised to continue playing a vital role in the state’s economy for years to come.

Read more blogs : Astrology and the Zodiac Signs of Serial Killers